Benefits

Made Simple

Virtus Labs stands at the forefront of financial consulting, offering unique solutions like the CHAMP Plan™ and SETC to empower both individuals and organizations.

Our Partners

What is CHAMP Plan™?

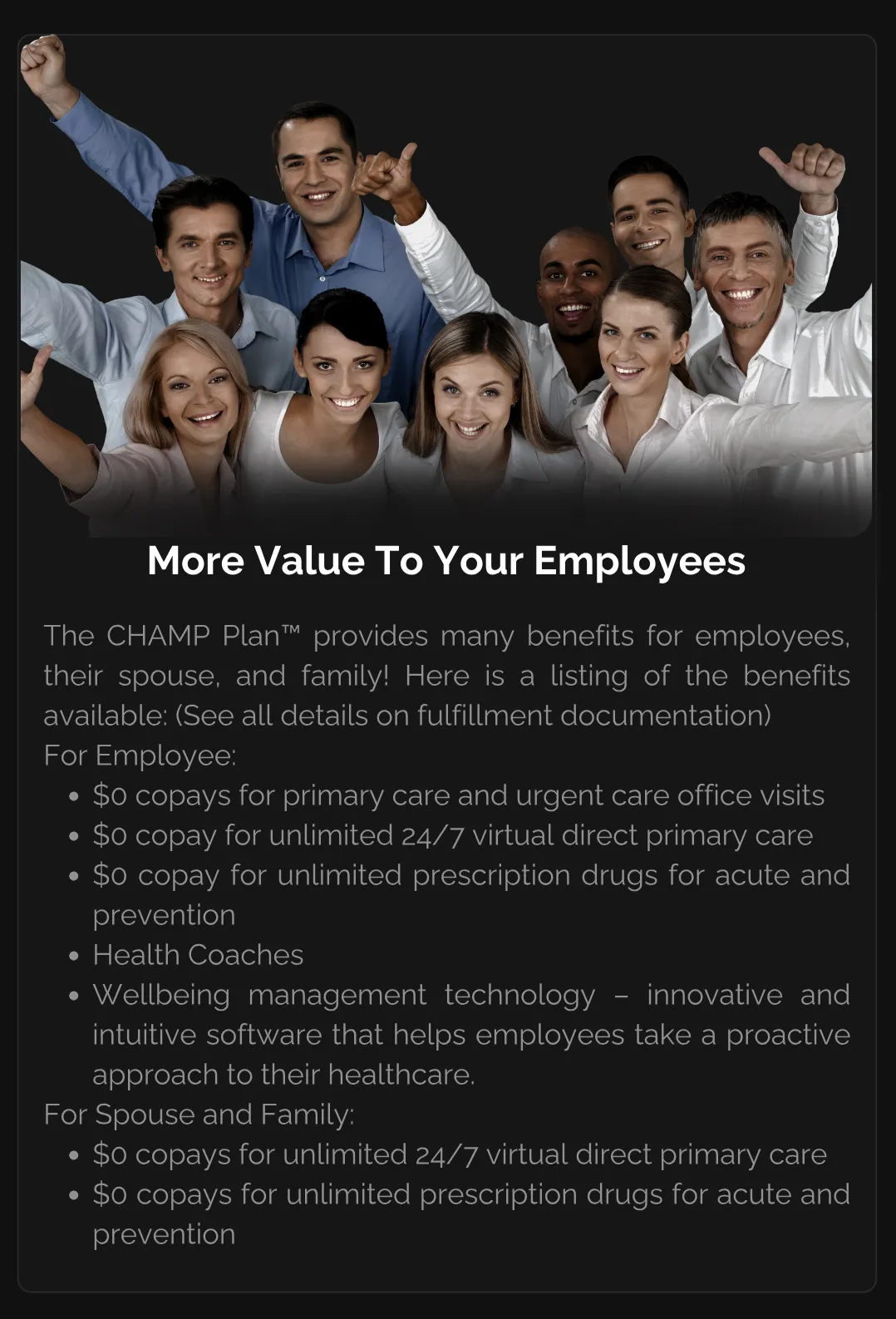

CHAMP Plan™ is a self-funded preventative healthcare program designed with both the company and employee in mind. Companies that offer CHAMP Plan™ save a fixed amount of $573.60 per employee, per year on their FICA taxes (instant savings) while each employee receives access to a suite of $0 co-pay/deductible benefits AND a modest pay increase.

Sounds too good to be true? Give us 30 minutes and we'll show you, in detail, exactly how this program is engineered and how it can help increase your company's bottom-line while providing your employees with top-of-the-line benefits at no cost.

THERE IS ABSOLUTELY NO OUT-OF-POCKET COST FOR CHAMP Plan™

Schedule a CHAMP Plan™ Presentation 👇

Get up to $32,220 for losses due to COVID-19

More than 47,000,000 self-employed Americans qualify for the SETC.

The SETC is a specialized tax credit designed to provide support to self-employed individuals that were affected by the COVID-19 pandemic. You may be eligible for up to $32,220 in tax credits. This is not a loan and is non-taxable.

VLabs Team

David Shinkel

Austin Howard

Sean Kelly

David Shinkel

Austin Howard

Sean Kelly

Calculate your savings with Champion Health™

CHAMP Plan™ doesn’t interfere with or replace any existing health plans. It provides the company a fixed savings of $573.60 per employee per year and provides the employee an increase in their net take home pay of around $1,500 per year, as well as $0 co-pay/deductible benefits + virtual care for the entire family at no cost.

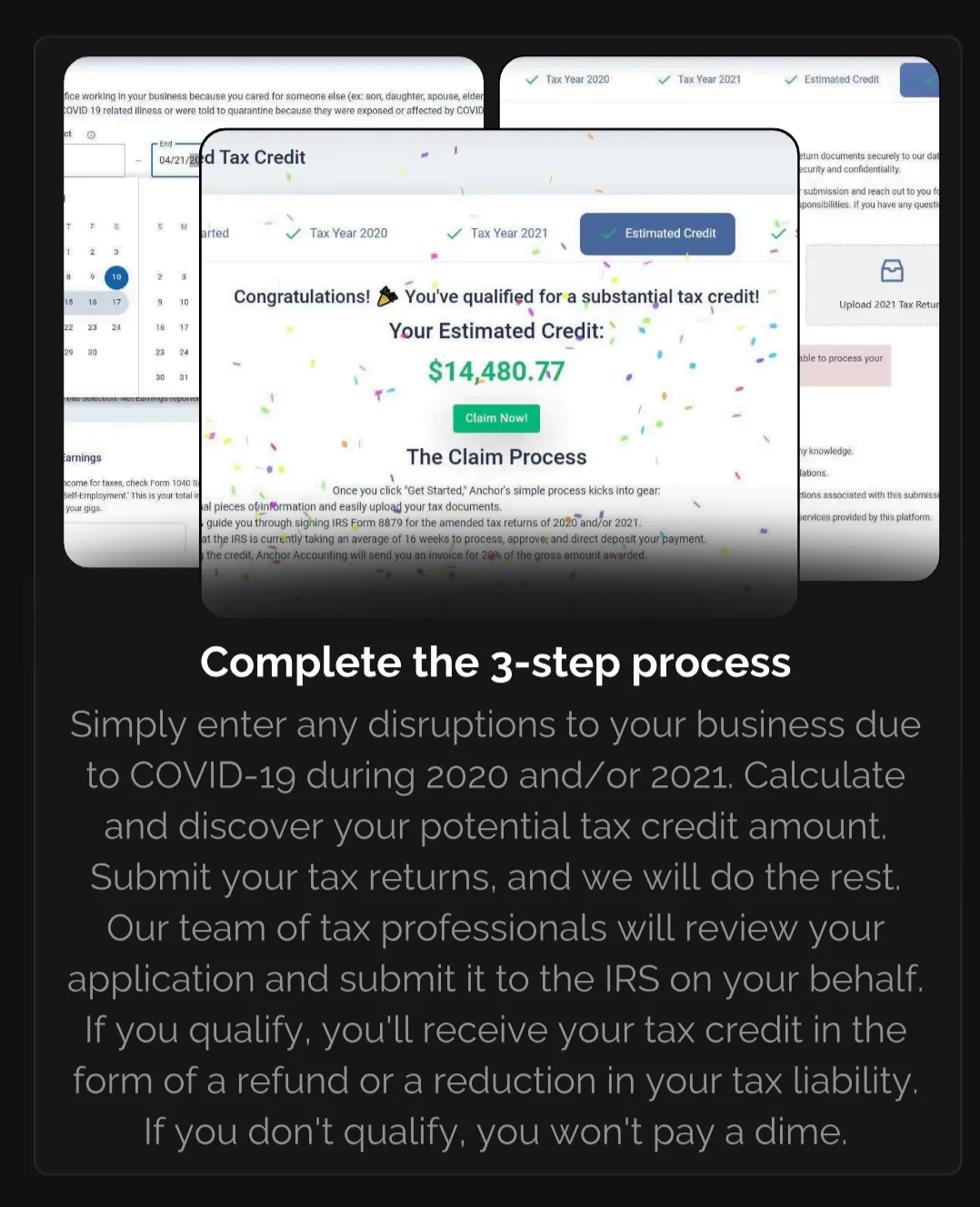

Claim up to $32,220 in as little as 15 days

If you were self-employed in 2020 and/or 2021, you could potentially qualify for the SETC refund up to $32,220.

This includes sole proprietors, 1099 subcontractors, and single-member LLCs. If you filed a “Schedule C” on your federal tax returns for 2020 and/or 2021, you're on the right track.

Calculate your savings with CHAMP Plan™

CHAMP Plan™ doesn’t interfere with or replace any existing health plans. It provides the company a fixed savings of $573.60 per employee per year and provides the employee an increase in their net take home pay of around $1,500 per year along with $0 co-pay/deductible in-person benefits + virtual care for the entire family at no cost.

Claim up to $32,220 in as little as 10 days

If you were self-employed in 2020 and/or 2021, you could potentially qualify for the SETC refund up to $32,220.

This includes sole proprietors, 1099 subcontractors, and single-member LLCs. If you filed a “Schedule C” on your federal tax returns for 2020 and/or 2021, you're on the right track.